JobKeeper 2.0 – Extensions and Changes

The first stage of the JobKeeper program has been taken up by 920,000 organisations, and around 3.5 million individuals over the April-May period. On the 21st July, the Federal Government announced an extension to the JobKeeper Payment program through to March 2021 to continue to support businesses impacted by COVID19. Whilst the program will continue, changes have been made to the payment figures as well as to the eligibility of businesses and employees to qualify for the JobKeeper payment going forward.

What’s Changed?

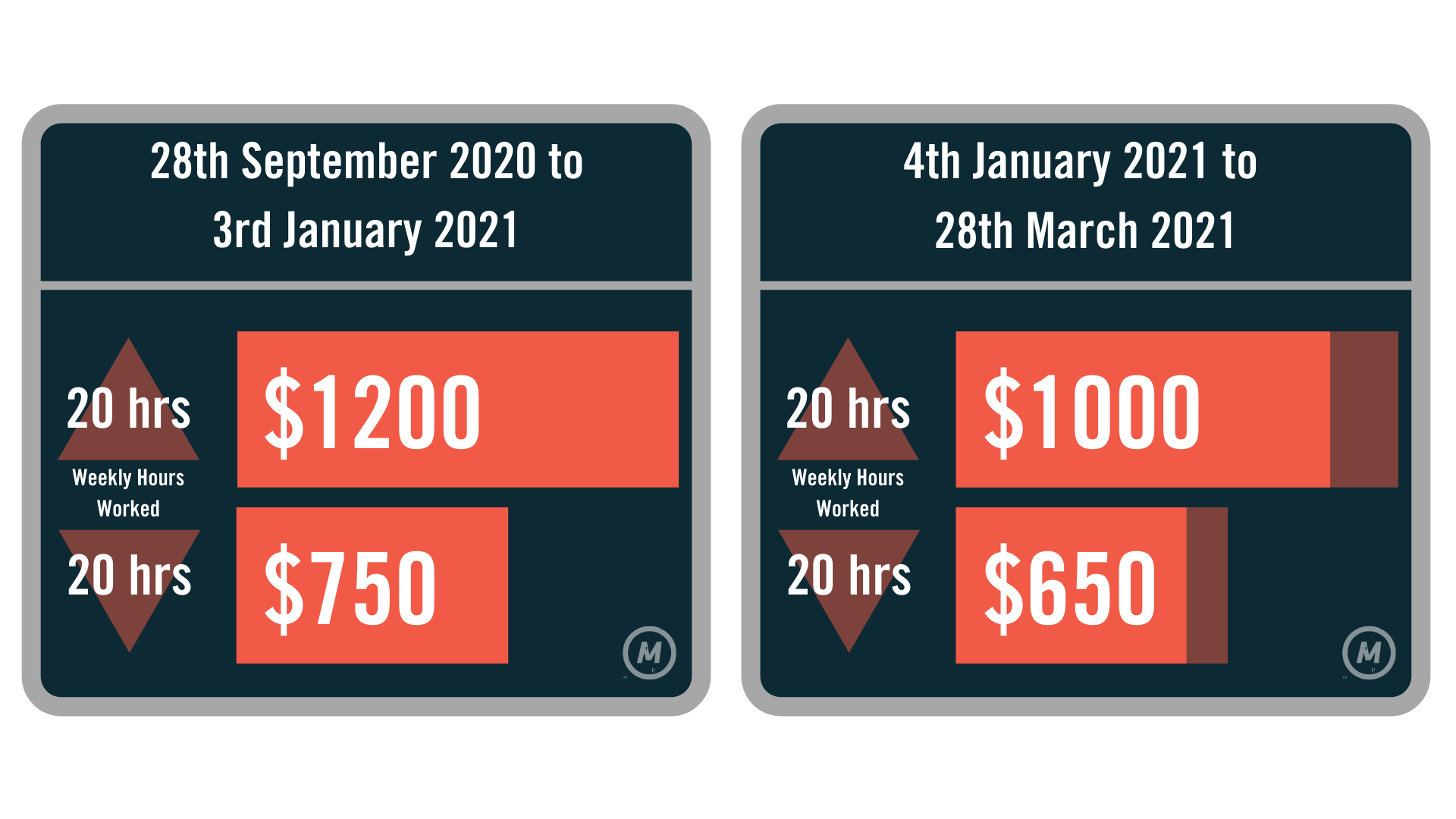

The current fortnightly rate of $1500 per eligible employee will be reduced to $1200 a fortnight from the 28th September 2020, and to $1000 a fortnight from the 4th January 2021.

For employees working less than 20 hours per week, lower rates will apply. $750 and $650 a fortnight respectively for the period from the 28th September 20203rd January 2021 and from the 4th January-28th March 2021.

To be eligible for JobKeeper payments after 27th September 2020, businesses and not-for-profits will have to meet tests for declines in turnover for each of the two periods of extension. Other eligibility rules remain unchanged.

Key Concern

Employees receiving JobKeeper payments also continue to accrue the benefits entitled to them under their employment agreements, including annual and sick leave. This means that where an employee to be terminated, the employer is still obligated to pay out the employee’s remaining leave.

The announced changes to the JobKeeper program made by the Federal Government have yet to address this aspect of the program, leaving further questions to be answered for business owners.

Commenting on the extension of JobKeeper, Mark Bouris said that the extension is, “a strong timely decision that derails community fear” instilling confidence that the government is still behind business owners and employees, providing the opportunity to retrain and reskill, and allow us to “create our way out of this once in 100 year event.”

Post